Brighter hope? Domestic debt profile of northwestern states drop in Q1, 2024

By Aminu Abubakar

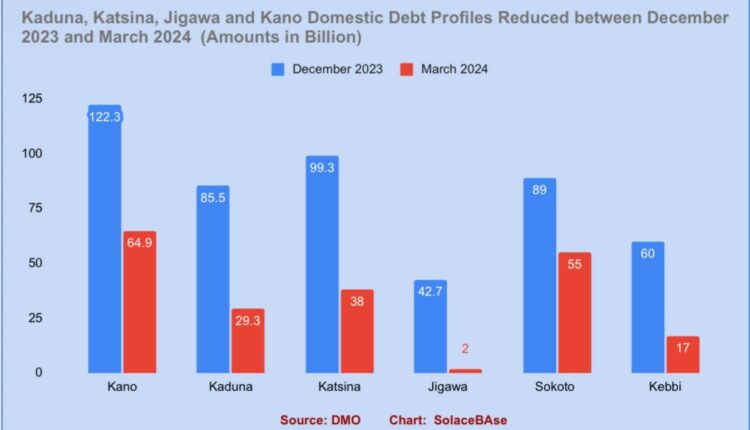

A SolaceBase review of debt management office data has shown that domestic debts of Northwestern states dropped between December and March 2024.

According to the review, Kano state domestic debt dropped from N122.3 billion to N64.9 billion.

In a related development, Kaduna state debt profile was reduced from N85.5 billion in December 2023 to N29.3 billion in March 2024.

Other states such as Katsina had their domestic debt profile dropping from N99.3 billion to N38 billion. Jigawa state debt was reduced by N40 billion, dropping from N42.7 billion to N2 billion.

Read Also:Nigeria secures $4.95 billion World Bank loans in Tinubu’s first year in office

Zamfara state’s domestic debt profile stood at N65.7 billion as of the first quarter of 2024, and Sokoto state’s domestic debt profile was N55.1 billion down from N89.2 billion recorded in the last quarter of 2023. Kebbi state’s domestic debt profile was also recorded as N17 billion, a drop from the N60.6 billion Kebbi domestic debts were put at as of December 2023.

As of the time of this report, there is no available data for the first quarter, 2024 external debt profile of states.

However, based on the most recent December 2023 external debt data, states such as Kaduna are owing highly on the external front with an external debt of $587 million, Kano $107 million, Katsina $50 million and Jigawa $25 million.

Read Also:Govt Loans: Crocodile tears in Kaduna- Tonnie Iredia

Nigerian States and Their Debt Management Issues

Reduction in domestic debt profiles of states may be a welcome development given that states have to spend billions of naira on debt servicing on a higher debt portfolio.

For instance, Kano state spent N9.5 billion on debt servicing in 2023. Kaduna State spent N27.3 billion on debt servicing in 2023 and N16 billion in the first quarter of 2024.

States have over time relied on loans as a source of revenue, given poor revenue generation.

Read Also:‘How we discovered fraudulent COVID-19 funds, World Bank loan at humanitarian ministry’- EFCC

SolaceBase recalled that there have been concerns over the debt servicing costs by states with experts noting that this development will hinder meaningful developments in states with monies meant for development expended on servicing debts.

Recently, the Kaduna state governor, Uba Sani, lamented that monies meant for salaries were being used to service debts, although his state debt profile has dropped by over N55 billion, the external debt data will give a broader perspective to the issues around debt management.

Already, SERAP has asked for a probe of states loan and how these loans are being managed by respective state administrations.

Comments are closed.