INVESTIGATION: How CBN’s multi billion naira loans to farmers turn ‘Buhari Bonanza’ in Kano

By Kolawole Omoniyi

• RIFAN Allegedly Set Warehouse Ablaze to Cover-up Fraud

• Farmers Accuse CBN of Under Services, Compromise, Negligence

Even though it was christened Anchor Borrowers Programme (ABP), many Kano farmers prefer to call the Central Bank of Nigeria CBN’s low interest credit scheme to farmers ‘Buhari Bonanza’.

Their impression is that the ABP – though its objectives were clearly highlighted from inception – is one of the so-called free ‘national cakes’ from President Muhammadu Buhari-led-administration.

“Ask any farmer about “Buhari Bonanza” in Kano, they will tell you that it is the nickname of the CBN’s Anchor Borrowers Programme.

“Many of them (the beneficiaries) are not willing to refund the loans despite our relentless efforts on recovery,” – Lawan Bello, Vice Chairman of Cotton Farmers Association in Kano State lamented.

Inaugurated in 2015, the CBN established the ABP to create economic linkages between smallholder farmers and reputable companies involved in the production and processing of key agricultural commodities.

The aim was to provide loans (in kind and cash) to the farmers to boost agricultural production, create jobs and reduce food import bills towards the conservation of the foreign reserve.

Anchor Borrowers’ Loans Gulps N800bn in Seven Years

The Minister of Agriculture and Rural Development, Mohammed Abubakar was quoted in December 2022 at the Feed Nigeria Summit in Abuja that four million farmers cultivating a variety of commodities on over five million hectares received N800 billion under the ABP in seven years.

Minister of Agriculture, Mohammed Abubakar

However, as the programme appears to be a turning point to farmers and the entire agricultural sector, the recovery plan of the loans from the farmers is shambolic.

Read Also: Investigation: How Rep member, agency abandoned communities, siphoned project funds in Benue State

This may not be unconnected with the level of corruption, negligence, poor execution and recovery plans among others extraneous factors hampering the scheme.

Corruption, Poor Implementation Mar ABP Recovery Plans

In Kano for instance, apart from the farmers’ perception about the ‘Buhari Bonanza’, Bello disclosed that many traders suddenly turned to farmers to enable them to benefit from the ABP.

He also accused some leaders of farmers’ associations and people in the corridor of power of favoritism.

“They added names of their friends and cronies to the list of the beneficiaries instead of the real farmers. Many of them sold the inputs immediately they got it.”

“Even big people like Chiefs, Divisional Police Officers, Districts Heads, Department of State Service, and some officials from the state ministry of agriculture brought their people and we gave them. They collected inputs for like five hectares, and ten hectares and nobody ask them for a refund.

“One man from Tarauni Local Government Area (LGA) popularly known as ‘Saraki’ allegedly used fake documents to receive plenty of items worth millions of Naira.

“He produced fake RIFAN slip distribution forms and succeeded in accumulating wealth through the program. He was arrested and taken to court recently, but nothing came out of it,” he explained.

Official Allegedly Re-loots Recovered Cash, Farm Produce

Bello, who doubles as the Chairman of the Kano South Recovery Committee noted that the committee was set up in the Kura cluster comprising Kura, Kiru, Bebeji, and Kano Municipal.

He said, unfortunately, one of the recovery officials, Saminu Kura allegedly re-looted some monies and farm produce that he recovered in the zone.

“He (Saminu Kura) did not remit to the headquarters; I have the evidence of the paper he signed. He collected over three hundred thousand and refused to remit. He also collected many items from Cotton farmers and sold it all,” Bello disclosed.

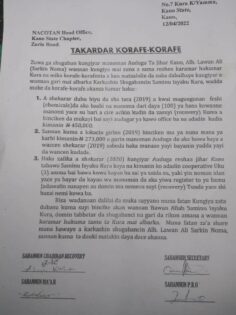

Documented Saminu’s Recovered Cash/Inputs Written in Hausa Language

Saminu Kura is currently at large and efforts of this reporter to reach out to him were not successful.

RIFAN Allegedly Set Warehouse Ablaze To Cover-Up N230m Fraud

Investigation disclosed that according to the operational guidelines of the ABP, the associations of each commodity are expected to keep the inputs they received from the CBN’s service providers in their respective warehouses at the state level for onward distribution to the LGAs.

In one such activity, Lawan Umar, Chairman of All Farmers Association of Nigeria (AFAN), Kano South Zone said the executive members of the state Rice Farmers Association (RIFAN) received inputs worth millions of Naira and allegedly set up the warehouse ablaze to cover up their fraudulent act.

“State Headquarters of RIFAN, about three years ago when they received some inputs under the ABP; they stored them inside a warehouse and put fire (set the warehouse ablaze). They later reported that fire has gutted everything.

RIFAN Chairman Denies Allegation

Reacting, Abubakar Haruna Aliyu, the RIFAN Chairman, Kano State Chapter confirmed the fire incident which occurred in May 2020 at the RIFAN warehouse in the Konar Maggi area within Kano metropolis.

Aliyu however denied the allegation that RIFAN’s executive members deliberately set the building on fire to cover up fraud.

“Truly there was a fire outbreak at our warehouse at Konar Maggi around May 2020 due to hot weather conditions. Many farm inputs/chemicals worth N230m were completely destroyed.

Read Also: REFLECTION: Iyabo Obasanjo writes father, says: ‘Dear Daddy, you don’t own Nigeria

“We have nothing to hide because we have records of all farmers who benefitted from the program,” he explained.

The Chairman, who noted that the state fire service and other relevant agencies knew about the unfortunate incident, however, challenged the security agencies to investigate the matter.

Rice Farm in Kura LGA

He added that many rice farmers had benefitted from the ABP in the state before the intervention was halted in 2022 due to poor recovery of loans from the farmers.

The RIFAN Chairman however attributed the low recovery from rice farmers in the state to the late distribution of inputs by the CBN and natural disasters such as drought and floods.

According to him, the suspension of the program might undermine the recent gains in agricultural production across the country.

How ‘Political Contractors’ Hijack ABP in Kano

Furthermore, the AFAN Chairman in Kano South Zone also accused the apex bank of engaging ‘political contractors’ for inputs procurements and distributions.

“They got somebody from Abuja supplying Kano seeds. Also, Golden Penny, Dangote, and Metrix are the best fertilizer-producing companies we have in Nigeria, they did not engage most of them, and what we got from other companies was below standard.”

“Poverty is forcing farmers to collect the inputs without minding the quality, so what kind of recovery are you expecting,” – he asked rhetorically.

He explained that many dealers are buying some of the ABP inputs from farmers at the point of delivery, hence defeating the purpose of the program.

“I know one trader who came from Sabongari to Kura and bought many spraying machines from farmers.

“The machines that were given to farmers at N43, 000 each as loans, the man bought them from the farmers at N20, 000. Now tell me how those farmers would get money to refund the loans,” he added.

CBN’s Global Standing Instruction for ABP Loan Recovery Ineffective – RIFAN

Disturbed by the low level of recovery of the ABP loans, the CBN September 2022 deployed the Global Standing Instruction (GSI) against loan defaulters under the ABP.

The GSI is a policy that allows banks to debit the accounts of loan holders in their banks to settle defaults.

But Ado Sarkin Noma, RIFAN Chairman in Kura LGA, clarified the reason such a policy might be ineffective despite having details of the farmers’ Bank Verification Numbers (BVN) during the registration process for the loans.

According to him, most of the smallholder farmers do not have a culture of saving in their banks.

He said they only opened the account and got a BVN for the purpose of securing the ABP loan. Hence no kobo was deposited in most of the accounts or elsewhere accounts that have links with their BVN.

Farmers Groan Over Late Inputs Distribution, Poor Orientation

In Gezawa LGA, Tijjani Adamu, Secretary of the Maize Farmers Association decried the untimely release of inputs and the little or no orientation given to farmers before the program kicked off.

“They (CBN) gave the farmers the inputs in 2017, 2018, and 2019, they gave us three consecutive times without asking for recovery, so it was the third time they were now asking for recovery, this is the reason many farmers saw it as a national cake,” he explained.

Recovered Maize Under ABP in Minjibir LGA

Corroborating Adamu’s position, Ali Ibrahim, RIFAN Secretary in Gezawa LGA said most farmers in the LGA were not aware of the terms and conditions of the ABP as stipulated in the guidelines.

“They (CBN) only carried along the executive members of each commodity at the state level. Many farmers and LGAs excos have no full knowledge of the program,” he noted.

Farmers Cry Out as Price of CBN’s Inputs Double Market Price

He also lamented the high cost of the farm inputs being supplied by the CBN, describing it as outrageous.

“The materials were too costly when compared to what is obtainable in the market but farmers were rushing to collect it due to poverty and their impression that it is the usual nation cake.

“For instance, we used to buy a water pump at N18, 000 in the market but the CBN supplied it at N39, 000. They (CBN) gave us a sprayer at N7, 000 instead of N3, 500. Organic fertilizer in the market is N500 but they gave us at N1, 800,” he narrated.

Remnant of Organic Fertilizers Supplied by CBN at Minjibir Warehouse

Also in Minjibir LGA, Jubril Muhammed Wase AFAN Chairman at the LGA also accused the CBN and other service providers of inflating the prices of the inputs. Wase claimed that the cost of production was higher than the outputs.

“The program appears to be putting genuine farmers into hardship because of the bureaucracy involved in accessing the inputs and their high cost. Sometimes we are directed by our leaders to give these inputs to people that are not farmers,” he explained.

One of the Sprayers Sold At N7, 000

Tomato Farmers Accuse Dangote Company of Failure to Remit N500m Recovered Loans

Meanwhile, tomato is among the commodities captured under the ABP loans. But Tomato Farmers in Kano have been suspended from the scheme since 2021.

Their suspension was linked to the alleged poor loan recovery, lack of storage facilities, and sustainable mechanisms.

Nadabo Mati, Chairman of the Tomato Farmers Association in Minjibir LGA, said the tomato farmers in Kano got about three billion naira worth of ABP loans before the suspension.

Mati attributed the low recovery to the perishable nature of the commodity and negligence. He also accused Dangote Tomato Processing Company of failing to remit about N500, 000, 000 that the company recovered from the farmers.

Dangote Tomato Processing Company

“From the beginning of the program, Dangote Company was contracted to be taking tomatoes from our members as part of the recovery plans.

“Despite the stress and cost implication of transporting the tomatoes to Dangote Company in Kura, we may be on the queue there for seven days waiting for the company to take the commodity from us, they always claim that their equipment was faulty”

“You know our product is perishable. Such delay sometimes costs us thirty to forty percent (30-40%) losses and the Company (Dangote) will not bare the loss”.

“Apart from that, we later found out that even the N500, 000, 000 worth of tomatoes that the Dangote Company recovered from us; the company did not remit it to the CBN’s designated account”. He furiously explained”.

AFAN Confirms Dangote Company’s Complicity in ABP Fraud

Also confirming the allegation against Dangote Company, Musa Shehu Sheka, AFAN Secretary, Kano State Chapter said the company was taken to court over the alleged unremitted N500, 000, 000.

“It is another market manipulation and nobody can query them (Dangote Tomato Processing Company). What we can do is to write a petition and take the company to court”.

“We (AFAN) took an action on the allegation by confirming the situation, we took the company to court, but we were told to go back and settle the matter amicably. Though, the case is still pending in court.” he disclosed.

Dangote Kicks, Blames CBN’s Refusal to Pay Shortfall

However, Abdulkadir Isah, Former Managing Director of Dangote Tomato Processing Company, in a telephone interview denied the company’s complicity in the alleged fraud.

Isah explained that from the onset of the program, his company entertained fear of getting buyers for the processed tomatoes, but the CBN allayed the fear.

“We all agreed to collect the fresh tomato from farmers and process it to tomato paste. But we asked CBN what is the market for the proposed tomato paste because the previous year we processed it nobody bought it from us”

“Up till now the stock we processed last year is still in our factory, so we don’t want to get into another issue again”. He noted.

The former Managing Director said his company notified the CBN that most of the companies packaging tomato paste in the country are importing from China, but the apex bank promised to compel them to patronize the Dangote tomato paste.

“The CBN assured us that those companies will be forced to patronize us by stopping the importation, so we said no problem. As the farmers were supplying the tomatoes, we were computing it and paying them but it got to a point that nobody was buying from us so we went back to the CBN”.

“Truly the CBN eventually introduced a company to us. But there was a shortfall in the negotiated price and the CBN decided to pay the shortfall. We also agreed that the shortfall be paid into the account of the tomato farmers association. But up till now, the CBN refused to pay the money”.

“We wrote to the CBN since 2019 season, we wrote another reminder yet no payment. I even have a copy of the letter. So that is the dilemma and the association is aware. So far we are not holding the farmers money” He narrated.

On the postharvest losses being recorded by the farmers due to the alleged delayed collection of the commodity at the factory, Isah also denied the allegation. He said only substandard tomatoes were rejected.

“There was never a day even when we are not running production that we have not accept any tomato brought to our factory. Some of these farmers will bring unripen tomatoes, those ones that can get routine and we have quality parameter, so those are the ones we reject outrightly”. He explained.

Poor Orientation about New Variety Mar Recovery from Wheat Farmers

Wheat Farming Under CBN’s Anchor Borrowers Programme

At the same time, Shuaibu Dauda, Chairman of the Wheat Farmer Association in Minjibir also complained over the late distribution of inputs and lack of proper orientation for wheat farmers in the state.

According to him, wheat farming is still new in Kano coupled with the nature of the new variety that was supplied by the CBN. He said the farmers were not conversant with the technicalities of its planting process.

“The variety is new, many of our wheat farmers are also new in the business. No proper mapping and examination of land before the distribution of the variety to ascertain its efficiency as outlined in the ABP guidelines.”

“As a result, we were told that we would get at least 35 bags per hectare with the new variety during the harvest period but we eventually got about three bags per hectare.”

Dausa, who described the loss as colossal, added that the insurance companies who were engaged and mobilized to rescue such a situation were nowhere to be found.

“Some insurance companies were contracted and mobilized to manage this kind of loss, we called their number repeatedly to witness what we were passing through, they promised to come but they never showed face,” he lamented.

AFAN Accuses CBN of Under Service, Poor Implementation

When contacted, Abdullahi Ali Mai Buredi, AFAN Chairman in Kano State, also cited the untimely distribution of farm inputs as the major factor that led to the low recovery of the ABP loans in the state.

“CBN caused the problem of low recovery. Inputs did not come until November/December instead of May of every year, so what we are getting we used it for dry season farming”.

“Some farmers will just collect the inputs and keep it till next year farming,” he explained.

Mai Buredi also disclosed that the ABP guidelines stipulate the responsibility of the apex bank to provide mechanization and aggregation funds to farmers to facilitate the smooth running of the program.

But according to him, the CBN breached the agreement following its refusal to make provisions for the aforementioned funds.

“Mechanization fee is meant for farmers to prepare their farmlands and take care of some pre-farming activities like the hiring of tractors, the guidelines say the CBN has to pay but they refused to release it”.

“Also, because the farms are clustered, the money to transport the recovered commodities from one farm to another before assembling it at the warehouse for onward transportation to the headquarters is called aggregation fee.

“Farmers were asked to take the inputs to the warehouse while CBN pays for their transport as captured in the economic cost of production. The aggregation fee per hectare is N10, 000 and they are not giving us, so how can we recover loans” He alleged.

Clarifying further on the challenge of the aggregation fee, Musa Shehu Sheka, AFAN Secretary in Kano, said apart from the refusal of the CBN to disburse the fund, the N10, 000 aggregation fee per hectare is not commensurate to the cost of loans recovery.

“The cluster Chairmen are agitating that how can they be going from one farm to another to recover loans for the CBN without remuneration. They will spend N2, 000 to N3, 000 for transportation of each bag they recover but the CBN is expected to pay N10, 000 per hectare”.

“The cluster Chairman will report to AFAN at the state level, the State will report to AFAN at the National level and the national will take it to the CBN, so if they (CBN) refused to release the aggregation fee, how can the recovery be seamless,” he explained.

Aggregated Grains Recovered from Minjibir Farmers Under ABP Scheme

The AFAN Secretary, who doubled as the state chairman of the Wheat Farmers Association of Nigeria, also berated the apex bank for rendering under-service in the entire value chain.

“For instance, N386, 000 was budgeted as the entire production cost per hectare for wheat farming, covering mapping, mechanization, inputs, harvest and aggregation cost, insurance service as well as monitoring and evaluation while the farmers are expected to refund the money in cash or kind at the end of each farming season”

“But later many farmers were using their money for the production while the CBN was only providing inputs and a few materials against the initial arrangement.” He narrated.

Just like farmers of other commodities had lamented, Sheka also complained about the late distribution of inputs to wheat farmers in the state.

“The good plantation period for wheat is between the 10th of November and the 20th of December but we are getting the ABP inputs sometime in January”

“Today is the 8th of Nov., two days to the plantation time, yet there is no mapping activity, no land preparation, and no approval. Later the CBN will come to recover loans from farmers and they want 100% recovery, who does that?”

The Secretary also had issues with the aggregation plan of the ABP for wheat farmers.

“They (CBN) proposed just 5, 000 for transportation of aggregated wheat per hectare and they are expecting 30 to 40 bags per hectare because the CBN is expected to buy all the wheat from farmers before sorting its own percentage for recovery according to the guidelines.

“So, how can just N5, 000 transport 40 bags of wheat to collation centers at the headquarters, let alone loading and offloading charges,” he complained.

CBN Accused of Illicit Withdrawal Shortly After Disbursement

CBN Governor, Godwin Emefiele

Sheka also accused the apex bank of sending money into the account of the wheat farmers at the national level and later withdrew the fund without due process.

According to him, the executive members who are signatories to the account only saw a debit alert without prior notification by the CBN.

“There was a time the CBN disbursed all this money into the wheat farmers’ association account but they later withdrew the money without seeking our (excos) consent. We petitioned the House of Representatives in Abuja over the development, yet no action was taken.

“The ABP package was full, the policy was excellent, but the implementation is below average,” he opined.

The AFAN Secretary also cited the under-services being rendered by the CBN as the major cause of the massive loan default in Kano.

“Harvesting allowance was not given to farmers, aggregation fee not given, some were not given water pumps, some were not given chemicals, if all these things were in place, we would have recovered more loans in the state,” he concluded.

Despite the aforesaid shortfalls, he said the wheat farmers in the state recovered about twenty trucks and bags of wheat and delivered the same quantity to the CBN.

CBN Declines Comments Over Several Allegations

Meanwhile, access to the apex bank office is strictly on appointment.

However, when contacted via telephone and email, the CBN denied several attempts by our correspondent to get the bank’s reactions to several allegations leveled against it by the farmers.

The first attempt to reach out to the bank at the Kano branch was in November 2022 when our correspondent contacted the Development Finance Officer (DFO), Mallam Jafar who is reportedly in charge of the ABP in the state via telephone.

Jafar politely promised to link our correspondent with the Branch Controller in Kano, but he later backed out. He thereafter sent the CBN toll-free line 0800 225 5226 to our correspondent, asking him to call the line for further inquiry.

After placing the call on November 15, 2022, the responder asked the reporter to send an email detailing the purpose of the request/interview and specific questions. The letter was written and sent to the designated email address on the 21st of November, 2022.

However, despite several reminders sent on the mail thread, there was no response hitherto.

Our correspondent thereafter updated the DFO in Kano about the difficulty in securing an audience of the appropriate quarter for the interview at the apex bank’s head office in Abuja.

Jafar simply said there is nothing he could do about it, citing bureaucracy.

This publication is produced with support from the Wole Soyinka Centre for Investigative Journalism (WSCIJ) under the Collaborative Media Engagement for Development Inclusivity and Accountability Project (CMEDIA) funded by MacArthur.

Comments are closed.