Northeast States’ domestic debt profile reduced in Q1 2024 with rising concern on anticipated borrowing

By Aminu Abubakar

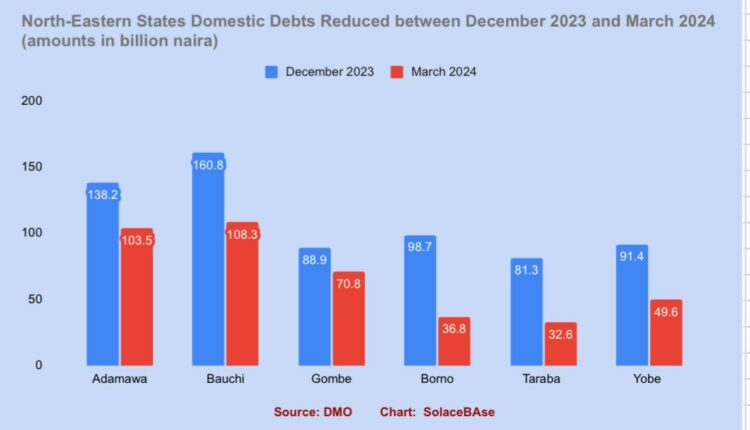

The domestic debt of North East states reduced in the first quarter of 2024. SolaceBase review indicates.

This development comes amid concerns on the rising debt profiles of states, although the debt management office is yet to release data on the foreign debt of states.

The review shows that Adamawa state debt was down from N138.2 billion in December 2023, to N103.5 billion in March 2024.

In Bauchi, the debt profile fell from N160 billion in December 2023 to March 2024.

Gombe state domestic debt profile reduced by N18 billion, from N88 billion to N70 billion.

The domestic debt of Borno state similarly reduced from N98 billion in December 2023 to N36 billion in March 2024.

Domestically, Taraba state debt reduced from N81 billion to N32 billion while Yobe state domestic debt dropped from N91 billion in December 2023, to N49 billion in March 2024.

Read Also:SolaceBase Data: How Kwara state expend more on foodstuffs, refreshments than critical capital needs

This development comes amid the unavailability of foreign debt data for March 2024. However, as of the most recent data on external debt released by the debt management office, Bauchi state external debt stood at $187 million while Adamawa was $103 million.

Gombe’s external debt was $54 million while Borno stood at $20 million. Taraba was $23 million while Yobe was $21 million.

The development of a reduction in domestic debt may be a reduction in the fiscal burden on these states especially in terms of debt service

The data review shows that Bauchi state spent N24 billion on public debt charges in 2023. Of this amount, foreign interest/discount on short-term borrowings gulped N5.102 billion while domestic borrowings interest took N19.390 billion.

Reduced Domestic Loan Portfolio Blighted by Plans to Borrow More in 2024

Northeastern states are relying on loans to fund their 2024 budget, a development that may increase the debt burden of these states and may rob off the gains made from the reduced gain as of March 2024.

For instance, Bauchi state plans to generate N37 billion, it plans to borrow N55.5 billion. N30.8 billion of the loan is planned to be sourced domestically while N24.7 billion is expected to be sourced externally.

Borno also budgeted N27.4 billion for its internally generated revenue but aims to borrow N41 billion. The domestic debt portfolio is expected to be pushed up by N25.5 billion in 2024, while foreign debt is planned to increase by N16.2 billion in 2024.

Read Also:Nigeria’s public debt hits N121trn- DMO

In Adamawa, there are 1.69 million poor persons, Bauchi state 2.69 million, Borno 920,000 poor persons.

In Taraba, there are 1.37 million persons, Yobe 1.36 million persons and Gombe 1.38 million persons are poor.

This is according to the Multidimensional Poverty Index Survey

This means that these states have developmental and human challenges that debt servicing and high debt profile may worsen.

Experts have warned that a growing debt profile will lead to reduced development in states, with monies meant to be spent on development expended on debt servicing.

Comments are closed.