JUST IN: Femi Otedola takes on Jim Ovia, exposes alleged fraudulent transactions in Zenith Bank account

The face-off between Femi Otedola, billionaire businessman, and Jim Ovia, chairman of Zenith Bank, over an alleged multibillion naira fraud has taken a turn for the worse.

Otedola had accused Ovia of unlawfully using the Zenith Bank account of his company, Seaforce Shipping Limited, to trade in 2011 without his knowledge or consent.

Although this and other allegations are being investigated by the Force Criminal Investigation Department (FCID) of the police, moves are being made to resolve the matters amicably.

TheCable has contacted Ovia and Zenith Bank for comments.

UNAUTHORISED TRANSACTIONS

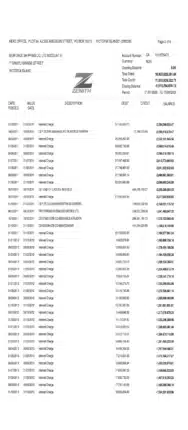

Despite having not been operated since 2010, Seaforce Shipping’s account continued to be used for trading — completely unknown to Otedola, according to his petition to the police.

Although Otedola said Seaforce never applied for nor took a loan from Zenith Bank, unauthorised trading running into billions of naira continued on the account.

When asked to provide documentation — including offer letters to support the grant of the said loans — Zenith Bank reportedly failed to do so.

Read Also:‘How churches, mosques are giving front-row seat, altars to fraudsters, corrupt leaders’ — EFCC boss

Otedola discovered the suspicious activities only recently — 13 years after the transactions — when he was tipped off by a whistle blower in Zenith Bank.

When he confronted Zenith Bank’s officials, TheCable learnt, they apologised.

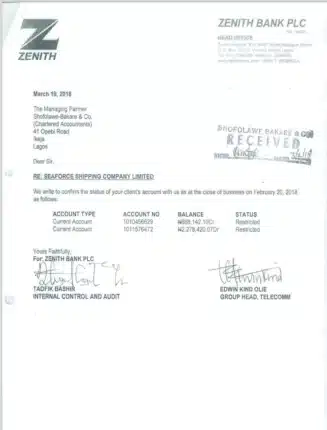

Otedola produced a letter written on March 19, 2018 by Zenith Bank to Shofolawe-Bakare & Co, Seaforce’s auditors, stating a debt of only N2,278,420 on the same account, as against the N5 billion recorded in the bank statement seen by TheCable.

Curiously, on the day the letter was written, the bank statement showed a debt of N2.9 billion — compared to the N2 million stated in the letter signed by Taofik Bashir (internal audit control) and Edwin Kind Olie (group head, telecom).

Transactions of over N16 billion were recorded against Seaforce’s account from 2011 to 2024.

Otedola queried who made the payments to reduce the purported debt from N16,927,628,581.84 to N11,010,924,522.71 because he was not in the know of the transactions.

There were credits of N77,169,375.00 on April 18, 2011, N119,822,762.50 on December 01, 2011, N316,537,329.30 on December 8, 2011, N266,361,181.73 on December 15, 2011 and N444,304,524.50 on December 12, 2011.

Seaforce now has a debt of N5,916,704,059.13 as a result, a chunk of it being interest charges.

A senior official of the bank has already been questioned by the police.

Meanwhile, Zenon, Seaforce, Luzon Oil and Gas, Garment Care Limited, and Otedola have secured a federal high court injunction against Zenith Bank, Quantum Zenith Securities and Investment, Veritas Registrar, and Central Securities Clearing System, restraining them from trading with shares or paying dividends.

This injunction subsists until the hearing of the motion on notice for interlocutory injunction.

Comments are closed.